Disclaimer: This post is a general overview of the baby steps and my opinions. It is not meant to replace Dave Ramsey’s books about the baby steps or financial peace university. I am not affiliated with Dave Ramsey or his companies.

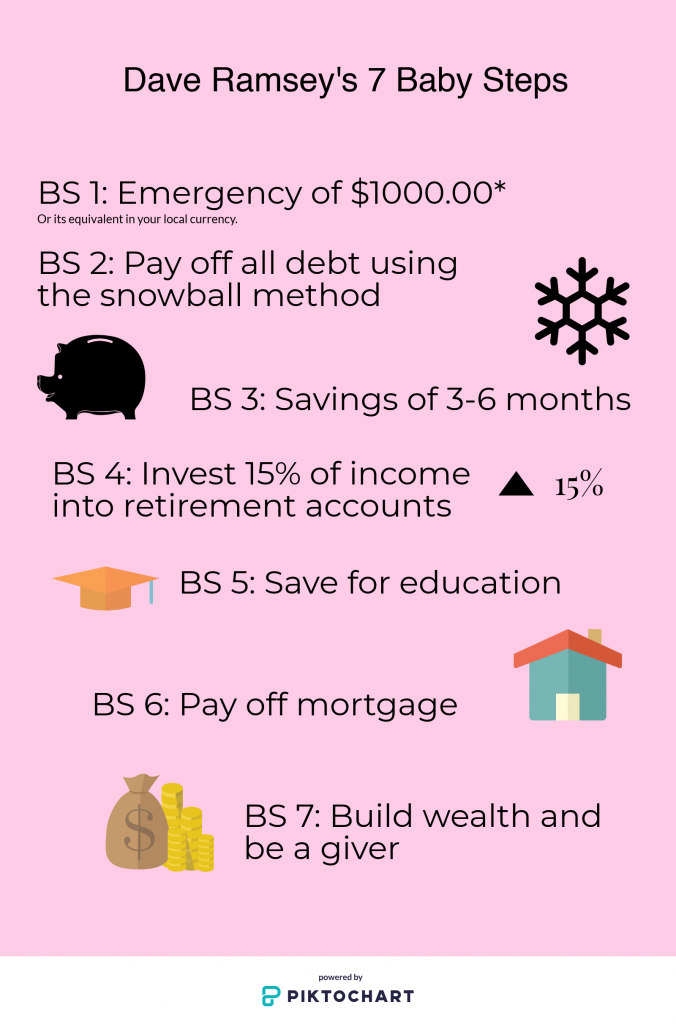

Some of you have heard of Dave Ramsey’s baby steps, which are a great starting point to paying off debt. There are seven steps total, but I’ve seen a focus on the first 3: $1000.00 in an emergency fund, paying off debt using the snowball method, and then building your emergency fund.

To use the debt-snowball payment method, line up your debts from smallest to largest. Once you have done this, you pay the minimum for all the debts but pay extra into the smallest. As you progress you add the original payments for the paid off debts onto the next one until you reach DEBT FREEDOM!

Additionally, there is another type of debt payoff method, not included in the baby steps. It is the debt-avalanche payment method. You line up your debts again but by interest rate, and you pay off the highest interest loan first and then continue on to the next until you pay off everything. This method saves you more money since you pay the least amount of interest.

However, some in the #debtfreecommunity and #firecommunity have some disagreement on the long-term effectiveness of these steps. There are variations but they all stem from these 7 steps but finance is personal. If the baby steps do not work for you, for whatever reason, do not feel ashamed to slightly tweak them. Especially if you own your house, $1000.00 would most likely not cover some unexpected repairs needed. A 3-6 month fund might be ideal.

I might get some flack for this but some people are die-hard fans of following the 7 steps. Which is fine, you do you, but not every method works for everyone. I personally feel more comfortable with having 6 months of an emergency fund and then aggressively paying my debt.

The baby steps rely on psychology, seeing the debt go down keeps motivation up. However, throwing all your income at debt is not sustainable and does not work for every income. As you are rushing to get out of debt, you do not build the tools needed for long-term financial growth. It is easy to fall back into the debt cycle. The famous saying “slow and steady wins the race” is applicable here. If you are the hare in this scenario and are throwing all of your income to the debt, you may become tired and give up. If you are slowly doing it and changing your lifestyle long-term, you are not likely to end up in the same mess afterward.

So be the tortoise!