I am not a tax preparer, this is all information you can find easily on the IRS and Skatteverket websites. This is not advice but it is a realization that many of us abroad who have student loans need to consider. You can read more here, this is written by a U.S. tax attorney. For more information on how this forgiveness could affect you, please speak to a tax advisor. Student loans and student loan forgiveness is a hot topic right now, especially during these trying times. Borrowers collectively owed ~$1.6 Trillion in 2019. What are the individual tax implications for those living locally and abroad?

Introduction

Student Loan forgiveness can create a tax nightmare for many borrowers. Even more so for those that are living abroad. I have recently been thinking about what this would mean for me and the others that are living abroad.

In the expat Facebook groups there was discussion if the $1200 is considered taxable income. It came down to that it was dependent on the country you are residing in and the tax agreement between the two countries. However, now that $1200 is not of concern to some, the loan forgiveness is.

Those living in the U.S.

The main issue with this mass debt cancelation (student loan forgiveness), even if it is partial, it can be considered as ‘income.’ This means that the debtor has to claim the amount forgiven and pay income taxes on it, as if they earned the income. The issue is that many borrowers would not afford that tax bill.

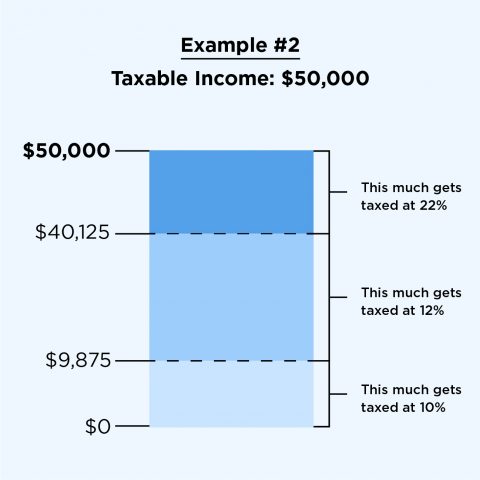

The U.S. has a progressive tax system, so those with higher taxable income pay higher federal income taxes. There are 7 federal tax brackets for 2020: 10%, 12%, 20%, 22%, 24%, 32%, 35%, and 37%. The bracket you are in depends on your taxable income and filing status. These are the rates for the taxes due in 2021.

How do they work?

Being in a particular tax bracket does not mean you pay that percentage on everything you make. Only on the portion that is taxable, this means a portion of it is not part of it.

Your income gets divided into chunks. This means that the government determines how much you owe by dividing this income into these brackets.

You can see the examples below produced by Nerdwallet.

What does this have to do with taxes?

Let us say you are example number 1. You earn a $9875 annually, so you pay 10% on that income. Now, you had a student loan that was $22,125, and this was forgiven. However, unfortunately for you the language in the forgiveness makes this a taxable event. This means you are paying 12% of that bill at tax time and that is due at once ($2,655), this does not include the 10% on the first part of your income.

However, these simplistic numbers might not be the correct percentages, if it is taxed, it could be at 30% which is much higher.

Now, you are starting to see how this can be problematic.

What about those living abroad?

This is where the language gets confusing and it depends on the tax treaty between the two nations. So, there is a double taxation agreement between the U.S. and Sweden. This means I do not have to pay double on my income that is in the U.S. or in Sweden. I pay tax only once, whether it be in the U.S. or in Sweden. The issue is that even with the language of a bill saying that it is not a taxable event in the U.S., it might be considered a taxable event in Sweden.

There was a court case between a Swedish citizen and Skatteverket (Swedish IRS) about whether the tax exemption of rolling over a 401K into an IRA could be applied under Swedish law. In the end, it was seen as a taxable event in Sweden. While it is a stretch and a huge reach, they might use this case as an example that despite it being a non-taxable event in the U.S., it is still a taxable event in Sweden. Currently, this is being discussed but there will most likely not be a decision until after it is certain.

Currently, I pay 20% of income tax as well, and it is progressive. However, in Sweden, we have a 30% capital gains tax. So, assuming that even if it is not a taxable event in the U.S. and Sweden does consider it as one, I would have to pay a large chunk to taxes.

To make this easy. If $50k worth of student loans are forgiven and it is considered a taxable event in Sweden but not in the U.S., and assuming a 30% tax on it… I would owe $15K to the Swedish government on my U.S. Federal Loans.

In other words, I would be screwed.